Landlords assume risks that prospective tenants may damage property or fail to pay rent for an extended period. All states permit property owners to collect security deposits.

However, each state limits the amount you can take, how long and under what circumstances you can keep the money after the tenant moves out, and how the money must be managed while held by the landlord.

The amount of security deposit you can collect from a tenant is influenced by several factors. These include:

Understanding these factors and your rights and responsibilities under your state's landlord-tenant laws is crucial before signing any rental lease agreement.

Every landlord should require a new tenant to pay the security deposit before moving in. The following are key factors to consider in determining how much you should ask for and if you have exceeded the limit:

Generally, find a balance to avoid charging too high to discourage prospective tenants or too low and incur additional expenses if the renter damages items, moves out early, or violates the lease agreement.

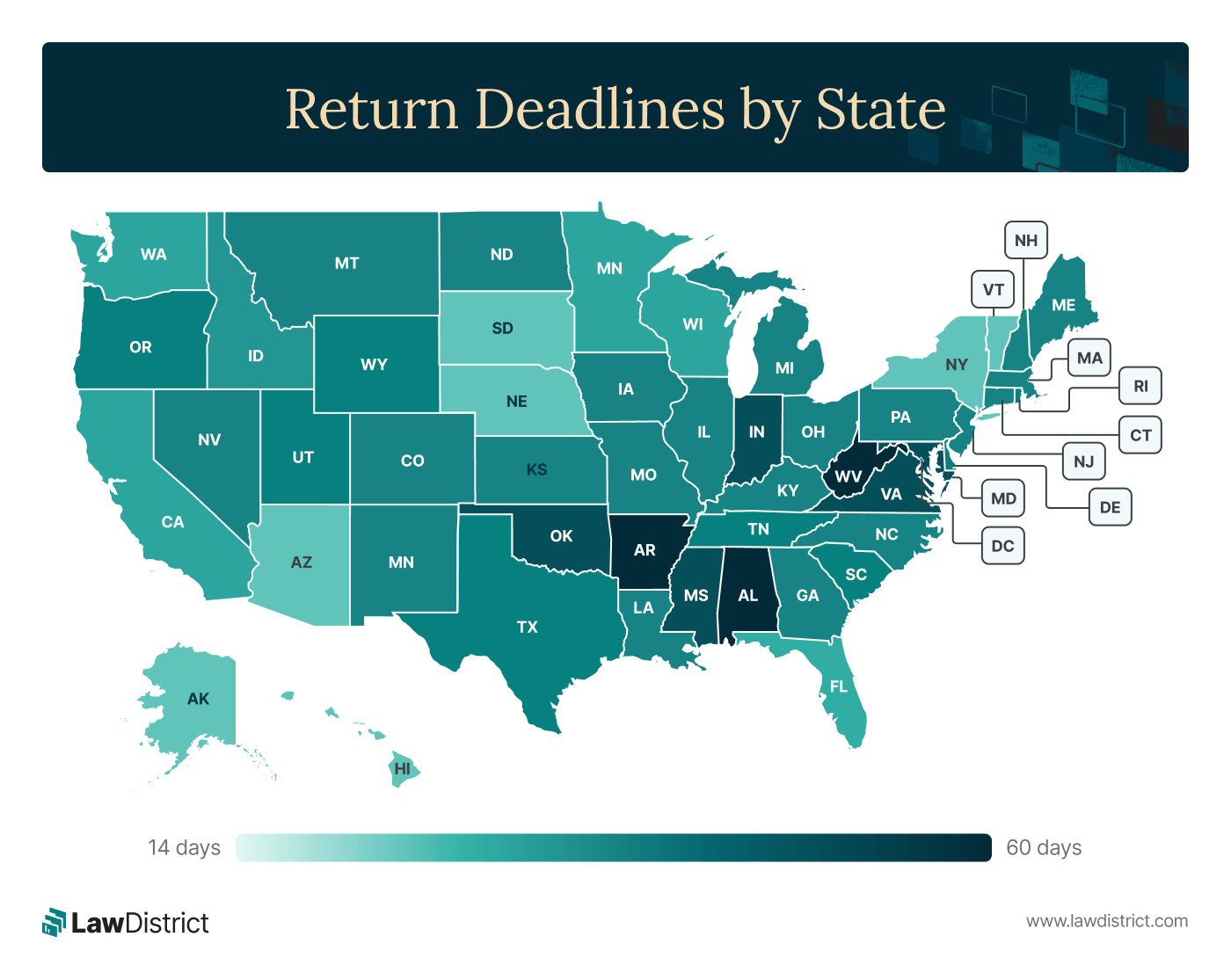

All states give a specific period for which a property owner must return the security deposit once the tenant moves out. The majority set it at 30 days. Alabama, Arkansas, and West Virginia give the longest deadline of 60 days.

Before returning the money, send the renter an itemized list of expenses and the deductions required. Ensure you gather receipts and invoices as you work on the rental unit because some tenants may object to the deductions.

The deductions you make depend on whether the landlord-tenant laws in your state permit it and what you include in your rental lease agreement. Ideally, the landlord should not charge for everyday wear and tear. Examples of permissible deductions across all states are:

You are obliged by law to return the entire security deposit if a tenant leaves the property in the same state they found it when they signed the lease agreement.

Seventeen states have laws that require landlords to pay interest on security deposits. They include:

However, specific requirements must be met in various states. For instance, you must have more than two rental units and hold the money for more than six months. Additionally, the interest you give the tenant varies by state. For example, Iowa requires you to provide the actual interest earned, Minnesota 1% interest on the security deposit per year, and Arizona 5% per year.

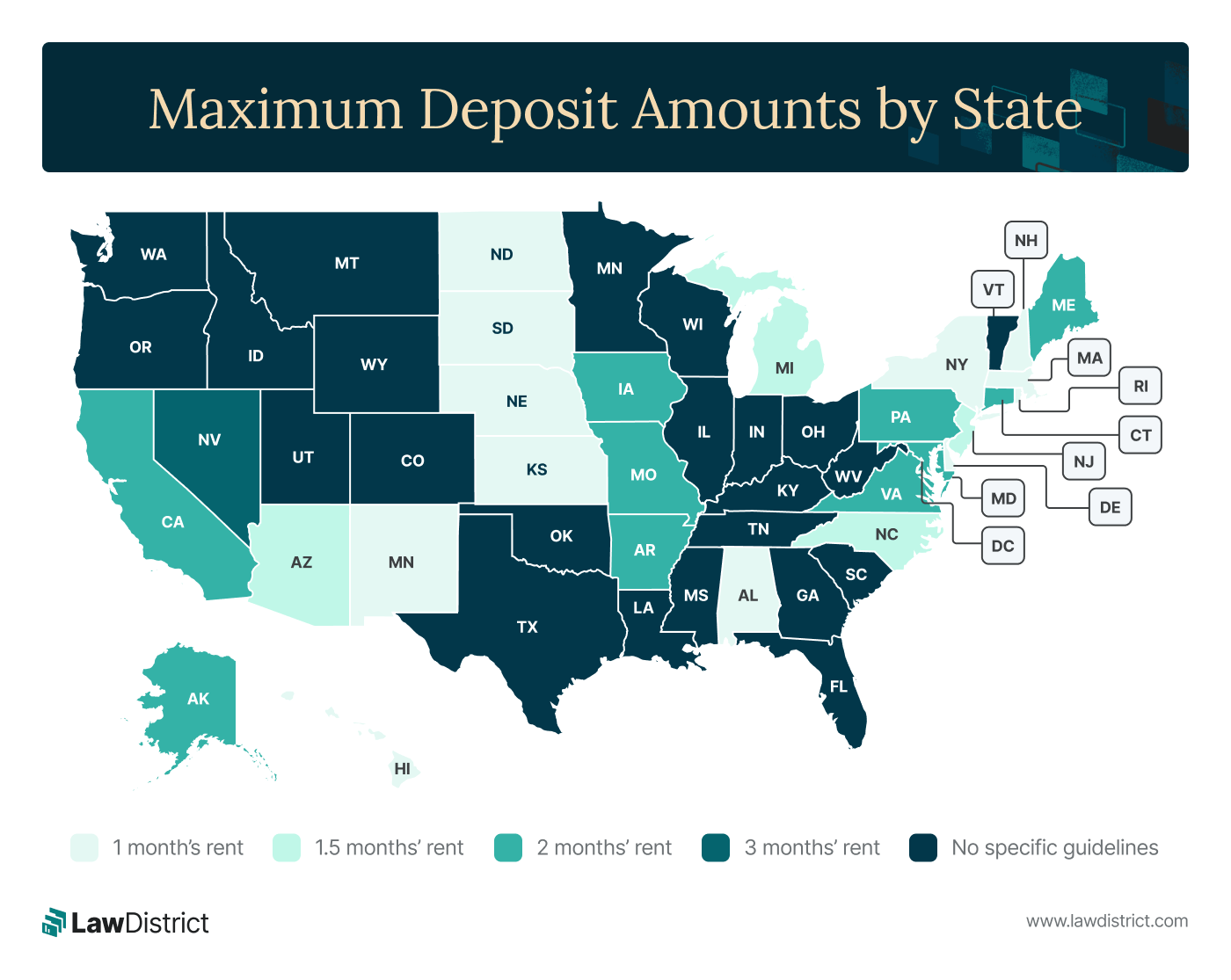

Here are some maps to show security deposit laws across the US:

The following table provides all 50 states’ security deposit laws for maximum deposit and return deadlines. Follow the link provided for a more comprehensive look at all the landlord-tenant laws specific to security deposits.

| State | Maximum Deposit Amount (in months of rent) | Return Deadline (in days) |

|---|---|---|

| Alabama | 1 | 60 |

| Alaska | 2 | 14 |

| Arizona | 1.5 | 14 |

| Arkansas | 2 | 60 |

| California | 2 | 21 |

| Colorado | No specific guidelines | 30 |

| Connecticut | 2 | 30 |

| Delaware | 1 | 20 |

| District of Columbia | 1 | 45 |

| Florida | No specific guidelines | 15 or 30 |

| Georgia | No specific guidelines | 30 |

| Hawaii | 1 | 14 |

| Idaho | No specific guidelines | 21–30 |

| Illinois | No specific guidelines | 30 |

| Indiana | No specific guidelines | 45 |

| Iowa | 2 | 30 |

| Kansas | 1 | 30 |

| Kentucky | No specific guidelines | 30 |

| Louisiana | No specific guidelines | 30 |

| Maine | 2 | 30 |

| Maryland | 2 | 45 |

| Massachusetts | 1 | 30 |

| Michigan | 1.5 | 30 |

| Minnesota | No specific guidelines | 21 |

| Mississippi | No specific guidelines | 45 |

| Missouri | 2 | 30 |

| Montana | No specific guidelines | 30 |

| Nebraska | 1 | 14 |

| Nevada | 3 | 30 |

| New Hampshire | 1 | 30 |

| New Jersey | 1.5 | 30 |

| New Mexico | 1 | 30 |

| New York | 1 | 14 |

| North Carolina | 1.5 | 30 |

| North Dakota | 1 | 30 |

| Ohio | No specific guidelines | 30 |

| Oklahoma | No specific guidelines | 45 |

| Oregon | No specific guidelines | 31 |

| Pennsylvania | 2 | 30 |

| Rhode Island | 1 | 20 |

| South Carolina | No specific guidelines | 30 |

| South Dakota | 1 | 14 |

| Tennessee | No specific guidelines | 30 |

| Texas | No specific guidelines | 30 |

| Utah | No specific guidelines | 30 |

| Vermont | No specific guidelines | 14 |

| Virginia | 2 | 45 |

| Washington | No specific guidelines | 21 |

| West Virginia | No specific guidelines | 60 |

| Wisconsin | No specific guidelines | 21 |

| Wyoming | No specific guidelines | 30 |

Consider carefully the laws in your state to avoid legal challenges from tenants who believe you are overcharging them. Ensure you know the answer to this question: what legal reasons can a landlord have to deduct from a security deposit?

In addition, document the state of your rental unit before and after a renter moves out and provide a genuine security deposit receipt showing the deductions made.

Make sure you have a landlord-tenant relationship and have all the documents you need to help you start and maintain a good tenancy period.

Helpful resources: